A deposit decline occurs when the payment cannot be processed for a particular reason. The transaction can be declined by the processor, the payment gateway or, what is the most common, by the issuing bank.

There are two categories of online deposit declines, and these are soft declines and hard ones.

The first one is when the issuer approved the payment, but there are some other problems with the transaction. Usually, retrying the transaction can help in such situations.

The hard decline, by contrast, is when the payment is not approved by the issuing bank, so the customer needs to contact the bank to resolve the issue.

Decline codes are provided when a transaction cannot be completed, so it’s good to know the explanation for each of them.

The Codes Explained

| 00 | REASON | EXPLANATION/RESOLUTION |

| 01 | Transaction Approved Successfully | The transaction is approved and completed successfully. |

| 02 | Refer To Card Issuer | The transaction is refused by the issuer, so the cardholder should contact the issuing bank to clarify the situation. You can suggest a cardholder to use a separate card or try again after resolving the issue with their bank. |

| 03 | Pick Up Card | The transaction is declined by the issuing bank that requested for retaining the card as it could be reported as lost or stolen. Ask the customer to use a separate card or contact their bank to resolve the issue. |

| 04 | Do Not Honor | The issuing bank is unwilling to accept the transaction. Ask the customer for a separate card to complete the transaction or ask them to contact the bank for more details. |

| 05 | Invalid Transaction | An error occurred while processing the card. Make sure that payments are correctly configured. |

| 06 | Invalid Amount | Double check what is entered and make sure it wasn’t negative or included incorrect symbols. |

| 07 | Invalid Card Number | The card issuing bank has declined the transaction because of an incorrectly entered credit card number or a number that doesn’t exist. Double check the card details and try processing again. |

| 08 | No Issuer | The customer’s card issuer doesn’t exist. Double check the card number and try processing the transaction again |

| 09 | The Card Was Declined | The customer’s card issuer has declined the transaction as the credit card is not enabled for online transactions.

The customer should use an alternate card or contact their bank. |

| 10 | No Reason to Decline | An unknown error has caused the authorization to fail, but there is no issue detected with the card or bank itself. Customers should be advised to attempt to process the transaction again. If repeated attempts are also unsuccessful, contact the issuing bank for investigation and resolution. |

| 11 | Bank Not Supported By Switch | The customer’s bank has declined the transaction because it doesn’t allow using the card for internet orders.

The error usually comes with the discover card, so the customer should use a separate card. If a discover card wasn’t used, ask the cardholder to contact their bank. |

| 12 | Lost Card | The issuing bank has declined the transaction as the owner of the card reported it as lost or stolen. Validate the customer authenticity and refer the cardholder to the issuer. |

| 13 | Stolen Card | The issuing bank has declined the transaction as the credit card owner has reported this card as stolen. Report the transaction attempt to the relevant issuing bank. |

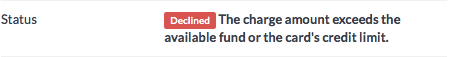

| 14 | Insufficient Funds | The transaction is denied by the issuing bank as there aren’t enough funds in the associated bank account to complete this payment or the transaction will put the customer’s credit card over the limit. Request the customer to use a different card or ask them to contact their issuing bank. |

| 15 | Transaction Not Permitted To Cardholder | The issuing bank has declined the transaction as this card cannot be used for this type of transaction.

Ask the customer to use another card or contact their bank. When the bank confirms it will process correctly, attempt the transaction again. |

| 16 | Withdrawal Limit Exceeded | The issuer has declined the transaction because it will exceed the customer’s card limit. Ask the customer to use another card. |

| 17 | Card Issuer Unavailable | There was a problem contacting the issuing bank to authorize the transaction. The customer should attempt to process this transaction again. If the problem persists, the cardholder should contact their bank. |

| 18 | Restricted Card | The card is invalid in a certain region or country or the customer tried to pay online with a card that doesn’t support the company's online payments. |

| 19 | Suspected Fraud |

The transaction is declined by the issuer because it appears fraudulent. Monitor all the transactions processed after the error occurred. |

| 20 | Holding | A hold means that although the funds has been received for deposit, the funds won't be available for use until the hold period has expired. This usually happens when there is; A. Incorrect routing or account number information B. Fraud is suspected C. The account is a new account (new account rules apply for the first 30 days the account is open) D. There is reason to believe the funds may be noncollectable E. The authorization was not properly endorsed |

| 21 | Reference Check Successful - Authorization Abandoned |

Authentication failure happens when: The wrong card details are entered |

|

22

23 |

Issuer or Switch is Inoperative

Charge attempt cannot be fulfilled until 1440 minutes |

A temporary error caused the authorization to fail. The issuer or switch is inoperative error typically indicates that the card issuer could not be contacted, or did not respond with an approval in time. Customers should be advised to try another transaction after few minutes. This implies customer is being blocked by Paystack's risk control system. It also means that the customer has carried out failed transactions using the card for more than 10 times. The card will be regulated and can only be charged once every 24 hours, which also means the customer can only use his card after 24 hours |

In summary, the most common online payment decline codes are related to the following issues:

- Expired card or incorrect card number

- The card declined based on location

- There aren’t sufficient funds in the bank account

- The card is over its daily/monthly limit

- The card is blocked by the bank’s fraud system.

Comments

15 comments

I need you to credit my account with that #500 I sent ok

Credit me my money back 500

Hi..pls I made a deposit of #1,100 on the 17th of October 2022 with bank transfer,which has not been reflected because of a mistake I actually made...instead of programming #1,100 on the paystack,I programmed #2000 instead..pls help me try and resolve this issue its getting long

Hi pls I made a mistake of funding #200 instead of #100

I need my account to be amount up by 5 cedis

Thanks it has been debited

Deposit of 6 cedis has been made but hasn’t reflected yet in my account

Deposited 29 cedis for 5 hours now but it is pending send it back to me please

I deposited 50 cedis two times since 12pm till now it’s still pending

Please kindly reverse my money or approve it

I have deposited money to place my bets but its not pending kindly reverse my money please

I have deposited money to place my bets but I'm not seeing any money in my bet account and they have already deposited me in my bank account

Please I made a deposit of 1000 naira and 700 naira and my bank have debited me but the money have not reflected in my msport account, please refund me back the money if you can't credit my msport account please do that now

I have deposited the money to msport 5000 my bank debited me and msport show me failed please refunded me

Please i made a mistakemistake by depositing 500 in a wrong please do something to that

Dear Customer, Thanks for reaching out to us. For the customer service issues, kindly contact us through our 24/7 Live chat through our website https://www.msport.com/ng/support/about/contact-us?chat=1 Have a nice day.

Please sign in to leave a comment.